How to Screen Tenants: Setting Yourself Up for Success

Finding the right tenant is one of the most important steps in managing rental properties. A great tenant pays on time, treats your property with respect, and reduces the risk of headaches down the road. But screening tenants effectively requires a clear process and consistent standards.

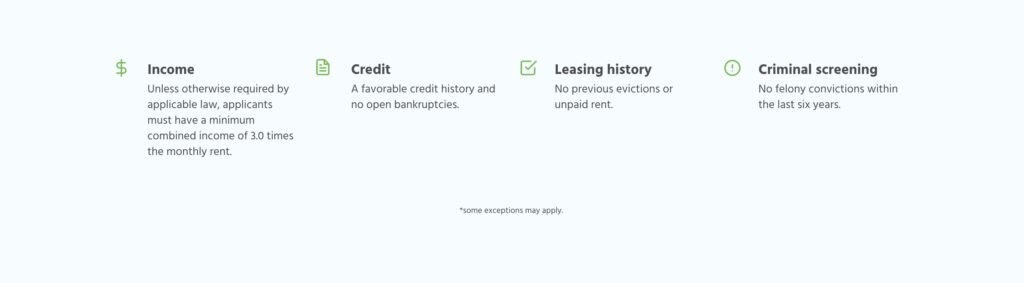

1. Set Clear Standards: Our Ideal Tenant

Before you even post your rental, define what makes a tenant ideal for your property. Setting standards helps you evaluate applications objectively and consistently.

- Monthly income: Typically three times the rent amount.

- Eviction history: Clean eviction report.

- Employment history: Steady and verifiable employment.

- Credit score: A reasonable score demonstrating financial responsibility.

- References: Positive feedback from previous landlords or personal references.

Here’s an example of how monthly rent translates to the minimum recommended income:

- $900 rent → $2,700 minimum monthly income

- $1,200 rent → $3,600 minimum monthly income

- $2,250 rent → $6,750 minimum monthly income

2. Have Serious Tenants Cover Screening Costs

One way to ensure applicants are serious is to have them pay for their own credit report and background check. Services like Zillow Rental Manager, TransUnion SmartMove, and others make it easy for tenants to submit reports directly. This reduces your upfront costs while still giving you critical information to make informed decisions.

By asking tenants to cover these costs, you also filter out casual applicants who aren’t truly interested in renting your property. It’s a smart, low-cost step in the tenant screening process.

3. Smart Management Starts Here

At this point, you’ve marketed your property and screened tenants without spending much—or anything at all—on corporate software. Once you’ve found the right tenant, you can use a state-compliant AI lease generator (free through Landlord Cart) to create your lease quickly and confidently. Rent collection and payments can be handled easily and securely through free services like PayPal, Zelle, or Venmo. After the lease is signed, Landlord Cart helps you stay organized with all your tenant records, maintenance requests, and property notes in one central place—so you manage your rentals efficiently without forcing you into a specific payment processor.

4. Stick to Guidelines to Reduce Risk

Having strict, clear standards doesn’t guarantee problem-free tenants—but it does significantly reduce the likelihood of eviction or late payments. Always check your state laws regarding security deposits and screening fees. For example, we typically require one month’s rent as a deposit. In cases where a tenant has limited credit history, some states allow asking for two months’ rent. This helps protect you in the rare event of an eviction.

Setting clear rules for applicants and following them consistently gives you confidence in your rental decisions while staying compliant with local laws.

Next Steps & Additional Resources

Screening tenants is just one piece of successful property management. For more tips, check out other blogs we’ve written, covering topics like marketing your property, rent collection strategies, and maintenance organization. Each post is designed to help you become a landlord pro, saving time and protecting your cash flow.

With proper screening, clear standards, and the right management tools like Landlord Cart, you can confidently find tenants who meet your criteria and keep your rental business running smoothly.