How to Set the Perfect Rent Price in 2026 (Without Leaving Money on the Table or Scaring Tenants Away)

Pricing rent correctly is one of the highest-leverage decisions a landlord makes. Charge too much and you sit vacant for months. Charge too little and you lose thousands every year. The landlords who consistently maximize profit do five things differently — and they all rely on free data + simple math anyone can do.

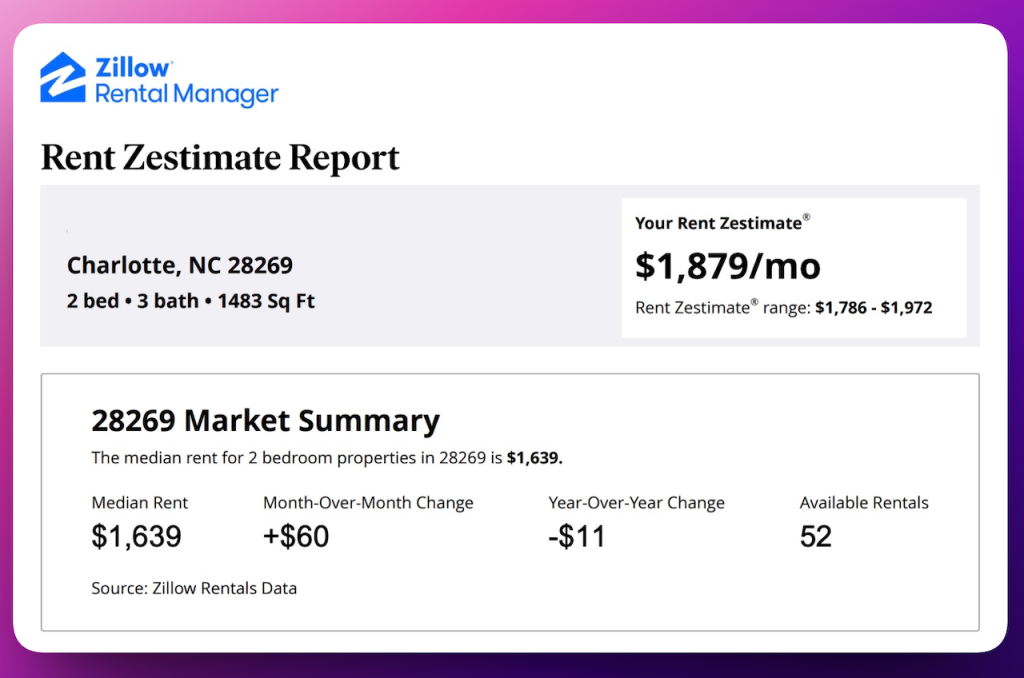

1. Pull Real Comps Using Zillow’s Free Rental Market Update (My Favorite Trick)

Forget guessing. Zillow now publishes a completely free monthly Rental Market Update for almost every metro and zip code. Here’s exactly how I use it in under 5 minutes:

- Go to zillow.com/rental-manager/price-my-rental → type in your exact property address → enter your email → instantly get a free professional rent range report + list of comparable rentals currently on the market (usually 8–15 real comps with photos and exact asking rents).

Cross-check with Apartments.com “Market Rent” tool and Rentometer (free for 5 reports/month) to get a tight range. I aim for the 70th–85th percentile of true comparables — high enough to capture upside, realistic enough to rent in under 14 days.

2. Use the 1% Rule as a Quick Gut Check (Then Make It Accurate)

Everyone knows the “1% rule” (monthly rent should be 0.8%–1.2% of property value), but most landlords stop there and lose money. Here’s the refined version top investors actually use in 2026:

-

- Take your total annual expenses (mortgage, taxes, insurance, CapEx reserve, vacancy reserve, property management, repairs, utilities you pay, HOA).

-

- Add your desired profit margin (most aim for 8–15% cash-on-cash return).

-

- Divide total annual cost + profit by 12 → this is your minimum breakeven rent.

-

- Compare to market comps. If market is lower → you either bought wrong or need to cut costs.

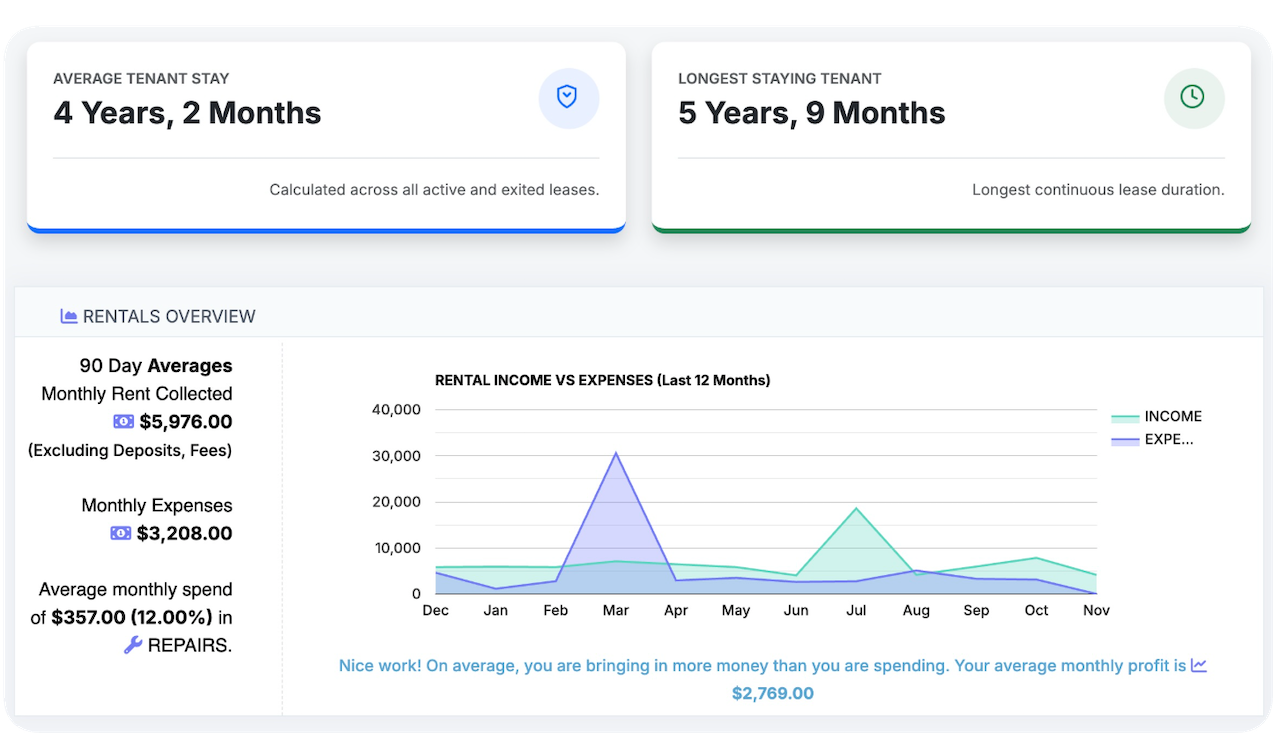

Pro tip: Landlord Cart’s Budget vs Actual feature lets you see exactly what you spent last year on each category (water, repairs, turnover, etc.). No more guessing — just export last 12 months and you have real numbers instead of averages.

3. The “Renewal Sweet Spot” Strategy That Cuts Turnover 40%

Good tenants are worth gold. The data shows raising rent more than 8–10% in most markets triggers move-outs. My personal rule:

-

- Year 1–2: Keep increases at inflation + 1–2% if they’re great tenants.

-

- Offer a small incentive (free carpet clean, $50 gift card, or waive pet fee increase) for signing 15–18 month leases.

-

- Only push to full market rent when they leave — new tenants expect it.

Result: My current portfolio average tenancy is 4.2 years (see screenshot below) compared to the national average of just ~2.1 years. Every extra year a good tenant stays saves me roughly $3,500–$5,000 in turnover costs (make-ready, cleaning, vacancy, leasing time).

Want to know your own number in under 30 seconds? Start your free 14-day trial or View Product Demo — it pulls the average instantly once your leases are in.

4. Build an Annual “Rent Review Calendar” (Takes 20 Minutes a Year)

Set a recurring calendar reminder 90–120 days before each lease expires:

-

- Pull fresh Zillow comps

-

- Check your actual expenses from last year inside Landlord Cart (takes 30 seconds) — try it free for 14 days or view product demo to see real numbers in action.

-

- Look at local vacancy rate (anything under 5% = landlord’s market)

-

- Decide new rent and draft the renewal letter

Doing this every year prevents the “oops I undercharged for 5 years” nightmare.

5. Tools That Actually Save Time & Money (Not Just Ads)

-

- Zillow Rental Market Data → free, updated monthly, shows real comps

-

- Landlord Cart Budget vs Actual → see exactly what your property costs to run instead of guessing

-

- Landlord Cart AI Lease Generator → Enter rent details “$2,350″ and in special instructions tell it details like “lease starting March 1, add pet policy: $50/month fee, $300 deposit, dogs under 50 lbs only” (or any other changes) and get a fully state-compliant lease addendum or amendment in under 30 seconds

-

- Rentometer & Apartments.com → quick second opinions

Bottom line: Landlords who use real data and review annually make 15–40% more net profit than the ones who “just pick a number.” Start with the free Zillow data link above — it literally takes 5 minutes and can add thousands to your bottom line this year.